It’s easy to think that your financial marketing is just about customers. Whilst they are undoubtedly important and the main focus, they aren’t the only people you need to factor into your strategy.

In the world of marketing for financial services, this is often conceptualised in the idea of your “stakeholders”. Here is a starting definition for the purposes of this guide:

“A stakeholder is an individual or collective [e.g. a business or bank] which has an interest in the affairs of your business, who is affected by it and who has at least some direct influence over it.”

Looked at this way, a financial planning business or similar company is likely to have many stakeholders with varying degrees of interest in your company; each with different levels of power. For instance, the stakeholders of a small financial planning business might include:

- Business directors

- Shareholders

- Business investors

- Existing clients

- Creditors

- Employees

- Local / national government

- The local community in which the business operates

Why is this important for your financial marketing? Crucially, your financial marketing refers to the messages your brand sends (and receives), both internally and externally. These messages can influence:

- New customers to avert or buy your product/service.

- Existing clients to remain loyal or recommend your business to others.

- Attract and retain business investors.

- Maintain and raise employee morale (i.e. “internal marketing”)

And so much more. So, as you can see, your financial marketing is not just about existing clients and prospects. It’s about influencing and communicating with your shareholders in a manner which helps your financial firm move closer towards its business and marketing goals.

However, how do you identify your stakeholders? How do you prioritise each one, and how should your financial marketing communicate with them? Let’s turn to those questions now, and if you would like to discuss your own campaign with us directly, please do get in touch for a free consultation.

The Mendelow Matrix

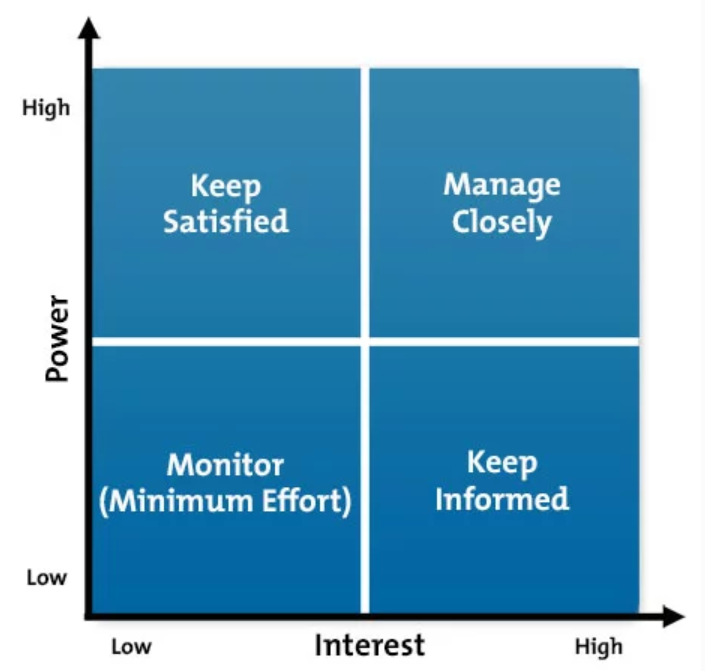

Fortunately, there is are some very useful conceptual frameworks available to help financial planners with these questions. The “Power-Interest” grid by A. Mendelow is a particularly useful and popular one, which we use here.

Essentially, this framework uses a four-square-box to categorise your stakeholders according to the level of power and interest they have.

Here is an example of the Mendelow Matrix below:

Source: Mindtools

As you can see, this matrix can be a really useful way for financial planners to categorise their various stakeholders, and devise a marketing strategy which accounts for each one.

For instance, if we take some of the stakeholders suggested in the introduction above, here is how some of them might feature within the Mendelow power grid of a financial planning business:

- Existing Clients (High Power; High Interest).

- New customers (Low Power; Low Interest, depending on the business lifecycle).

- Local/national government (High Power; Low Interest, depending on the business).

- Employees (Low Power; High Interest).

Once you have compiled your various stakeholders (internal and external) into your grid, it becomes a lot easier to identify which ones require the most immediate attention.

For the above financial planner, there is a strong case that existing clients should form occupy the central attention of the marketing strategy. After all, these individuals have a high interest in how the business is run since this directly affects the quality of financial advice they receive as well as their investment performance. They also wield a lot of power, since the business model of a lot of financial planners rests on maintaining a loyal, profitably client bank over several years and even decades.

On the other hand, customers who have not yet heard of the financial planning brand will likely have little interest in the business at the very outset; although this will increase as the company’s marketing efforts generate more interest, and nurture them through the sales pipeline. Moreover, so long as the financial planning firm currently has a strong, profitable client-base these new customers will likely wield less power over the business; since they have the luxury of being selective with bringing on new clients. Startup businesses, on the other hand, are likely to experience more stakeholder power amongst new customers, since they will need to bring these individuals on-board in order to expand their client base.

Financial Marketing Strategies for Different Stakeholders

A mentioned above, your financial marketing strategy will need to “speak” to your different stakeholders depending on their interest and power within your business. Fortunately, the Mendelow Matrix provides a fairly straightforward set of strategic recommendations for the four different stakeholder types:

- High Power; High Interest. These people need to be managed closely since they are the most important stakeholders. They will need continuous engagement and attention, which might involve tailoring your marketing strategy to provide regular updates about performance etc.

- High Power; Low Interest. These people need to be kept satisfied. Don’t pester them, but don’t neglect them either. Offer continual value to them, as well as your availability/support.

- Low Power; High Interest. These people should be kept informed. For instance, employees might be kept in the loop via a monthly internal newsletter.

- Low Power; Low Interest. Keep an eye on these individuals and collectives, but don’t spend too many valuable resources on them which could be put to better use elsewhere. For instance, if you are a financial planner with a strong, profitable client base who is not looking to significantly grow your business, then why spend thousands on financial marketing intended to generate new leads? However, if you are an IFA startup looking to attract new clients, your customers will have more power and (possibly) more interest, allowing you to justify higher marketing investment.