Introduction to Financial Adviser Newsletters

What kind of newsletter should you send to your clients? Setting aside printed newsletters, financial firms are broadly faced with two options – using an HTML or “e-newsletter”, or using a PDF newsletter.

Here at CreativeAdviser, we offer both versions to financial planners and financial advisers. Each type has its own advantages and disadvantages. One might be more appropriate for a financial firm depending on its needs, goals and clients.

The Power of an HTML (or “E”) Newsletter

With that said, HTML newsletters tend to hold greater potential for digital marketing than a printed solution – also, making it superior to a PDF newsletter:

-

Cost-efficiency.

-

Drive Website Traffic.

-

Increased Engagement.

Understanding Your Audience

Without understanding your readers, your financial adviser newsletter could fall flat. With a clearer picture, however, your messaging and calls to action will be far more effective.

Data gathering will be important to this process of gaining insight. Consider segmenting your client base by demographics, investment goals, age, gender, income, net assets and risk tolerance.

Personalisation Techniques

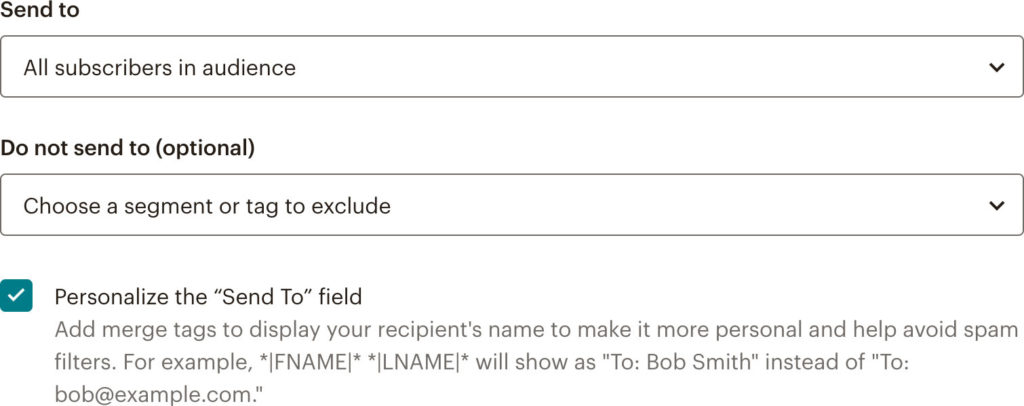

A simple, powerful way to tailor your client newsletter to each recipient is to call them by their name. Many email marketing platforms allow you to do this using a “campaign builder” tool which integrates with your uploaded email list.

Another powerful approach is to include testimonials, case studies or success stories from clients in your newsletter – adding credibility and social proof. You could also invite clients to provide feedback or suggestions for future content.

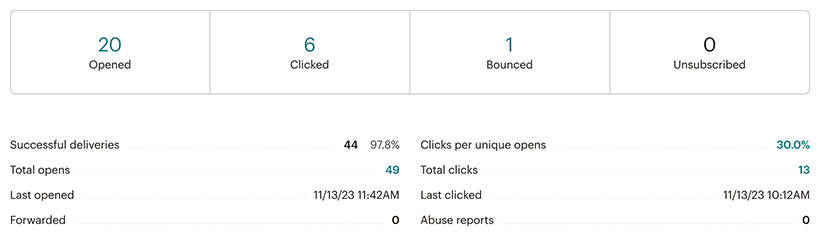

Finally, consider tracking the analytics of your financial newsletter. This will help you discern which topics, subject lines and calls-to-action are resonating with your readers.

The Power of Storytelling

Financial advisers need to try and make complex financial topics relatable and memorable. Some great ways to do this include using anecdotes, case studies and narratives of overcoming challenges.

Many wealth managers and other professionals are fearful of letting their client newsletters “stray” into entertainment or emotional content (in case someone gets offended). However, most people enjoy a good story and will better relate to the characters and situations you describe.

Strategies for Newsletter Distribution

How can you ensure that your client newsletter travels as far as possible once it is sent out? Here are some ideas:

- Integrate Social Media.

- Use Website Sign-Ups.

- Encourage Sharing.

- Offer Incentives.

- Optimise Timing.

- Monitor Analytics.

Managing Financial Newsletters Via Automation

Automation tools help to streamline newsletter management, from content creation to distribution.

At its simplest, this involves scheduling your campaign for an ideal sending “window”. However, you can take this all to another level by scheduling personalised messages and follow-ups based on client behaviour and preferences.

Taking this idea a step further, client newsletters can also be designed with specific “triggers” so emails are sent to recipients based on actions they take. For instance, if a client is spending a lot of time looking at their portfolios, perhaps they are worried about their investments. Here, an automated email could be sent to them, perhaps warning about the dangers of “investor bias”.

Optimising Via A/B Testing and Experimentation

Refining financial advisor newsletters does have a science to it. A/B testing involves testing two different versions of your campaign – with a few changes to each one – to compare them. Here are some tips on how to get started with A/B testing:

- Test one variable at a time (e.g. subject line).

- Run the tests simultaneously.

- Make sure the audience is segmented properly.

- Implement winning versions and build on those.

Compliance Considerations

It should go without saying that independent financial advisers should ensure that their newsletters adhere to regulations set forth by governing bodies like the Financial Conduct Authority (FCA). Be careful with the following:

- Avoid misleading communication

- Ensuring accurate information

- Include proper risk disclosures

- Be transparent with any promotion of financial products.

How to Measure Success With Metrics

The three main metrics to watch for your client newsletter are open rates, click-through rates (CTRs) and conversion rates. Other important data points include subscriber growth, engagement levels and client feedback.

“Open rates” refer to the percentage of recipients who opened the email. Naturally, the higher the percentage, the better. Across all industries, the average open rate is about 21%. If you can beat this benchmark, you are off to a good start.

Click-through rates measure how many readers click on an important link in your newsletter – such as an article. Here, you can look at the overall CTR for a specific campaign as well as CTRs for individual links, giving you an idea of which content is working best (to help inform decisions about your next newsletter).

Conversion rates are “meaningful actions” which people take as a result of reading your newsletter. For instance, if someone downloads a PDF guide from your website or books onto your next webinar about pensions after reading your client newsletter, you could define this as a conversion.

Staying Relevant: Curating Timely Content

One of the hardest balances to strike with client newsletters is deciding on the ratio of “evergreen” to “timely” content. The former refers to articles which last a long time. The latter usually expires fairly quickly but is highly topical, such as discussing a recent event in the markets.

You will need to take your own marketing goals and unique client base into account when deciding on the balance for your financial firm. For instance, an investment firm might lean more towards more topical content if its readers are active investors. However, a financial planner may wish to focus more on article topics which will stand up to compliance demands for a good length of time.

The Benefit of a Content Calendar

One of the biggest pains with a financial newsletter is figuring out what to write about!

Fortunately, you can limit this problem with your client newsletter by maintaining a content calendar – outlining the topics, say, 3 months ahead of time.

This helps to guard against “over-concentration” when choosing topics. By planning ahead of time, you can maximise your chances of striking a healthy balance across your financial services – e.g. pensions, tax planning, inheritance tax and protection.

Forward planning also opens up more opportunities for collaboration and communication. If you know that you want to write a definitive piece on pension transfers in 2 months, for example, then you might have time to ask an outside expert to contribute to the article – boosting its intrigue and authority.

Engaging Clients with Interactive Content

The financial services industry is notorious for being behind the curve, compared to other industries, when it comes to interactive content. Here, you could have an opportunity to stand out from the crowd. Here are some ideas for your digital newsletter:

- Polls

- Quizzes

- Surveys

- Interactive infographics.

Use Optimal Calls-to-Action

Make sure your newsletter invites your readers to “do” something. Include clear calls-to-action (CTAs) such as “Learn More,” “Get Started” or “Claim Your Free Guide.”

Always think about where your newsletter readers are in the “buyer’s journey” when choosing CTAs. For instance, asking current clients to book a free consultation will likely be inappropriate (they are already on your books!).

However, this might be suitable for prospects who have signed up for your client newsletter via your website because they are interested in hearing more about what you have to say on important financial topics.

If your CTAs are not working properly, think about how you could test different versions to maximise their effectiveness. Even “small” things like button colour, positioning and font choices can have a huge impact on your conversion rates.

Design Tips for Engaging Financial Adviser Newsletters

Financial advisers can boost the readership of their client newsletters by building an eye-catching layout, crafting compelling subject lines and offering valuable content. Here are some ideas to consider:

- Avoid cluttered layouts and overwhelming design elements.

- Grab readers’ attention with compelling headlines and high-quality images.

- Use white space, or negative space, to create balance and readability.

- Optimise for mobile devices.

- Break up large blocks of text with headers, subheadings, and bullet points to make the content more scannable and easier to digest.

Ideas to Boost Subscription Rates

Ideally, you want to get as many qualified prospects reading your newsletter as possible. One way to do this is to promote it across different channels, such as in your social media profiles and in your printed event materials (e.g. leaflets).

Another tactic is to ensure that your financial planning website includes prominent sign-up forms for your newsletter. You could offer incentives for doing so (e.g. e-books). Here, you can boost your chances of success by including social proof, such as reviews, to boost trust.

For website visitors, optimise your landing pages so they are geared towards newsletter sign-ups. Persuasive copy and compelling visuals will be beneficial for this, highlighting the clear benefits of subscribing.

Should I Use Testimonials and Case Studies?

Including testimonials is a great way for financial advisers to show that they listen to their clients and put their needs and interests first. Rather than spending all your time talking about yourself, you are making space for your clients’ voices to be heard!

Case studies help to anticipate objections and concerns that readers might have. By highlighting common client problems and how you helped to solve them, you put their minds at ease that you are proactive in your pastoral role as a “financial custodian”.

Finally, client stories are a great opportunity to show your unique selling points, success stories or testimonials which set you apart. These all help to different you from competitors and boost loyalty.

Ensuring Mobile-Friendliness

The financial planning world is still heavily littered with outdated websites and newsletters which fail to “respond” to modern devices. Make sure you are meeting the needs of your “on-the-go” client readers!

Optimise your layout and font size for small screens to minimise the chances of readers getting frustrated (everyone hates “pinching” their screens to make text larger to read!).

Test your financial newsletters across various devices and email clients to ensure compatibility and functionality. Remember, new devices and email technology are constantly evolving and you need to ensure that your newsletter is keeping up with any changes which may affect the reading experience.

How Can I Re-Engage Inactive Subscribers?

The older your email list, the more likely you will have “inactive” subscribers. Fortunately, there are ways to re-animate them so that a decent percentage of them engage again. Here are some ideas:

- Remove consistently inactive subscribers.

- Let subscribers choose their email frequency.

- Run some personalised re-engagement campaigns.

- Ask for feedback. Why did they stop reading your newsletter and how could you help?

- Try re-engaging from a different angle – e.g. social media, retargeting ads or direct mail.

Addressing Market Volatility

Here, the key is to strike a balanced approach whilst providing reassurance and guidance.

Explain the reasons behind the volatility and its normalcy in financial markets. Provide historical examples of market downturns and subsequent recoveries.

Offer support if clients are worried. This might involve pointing them to helpful resources or reminding them that they can speak with you directly.

What About Email Frequency?

The best way to preserve client relationships with your newsletter – not “overloading” or “underserving” them – is to ask them about their desired frequency.

As a general rule, we have found a monthly newsletter to be ideal for financial advisers. However, some firms may benefit from a less regular approach – e.g. once every two months, or once per quarter.

Once you decide on a frequency, stick with it for a while to see what the results are. You could even run a “split test” by letting one group of subscribers receive your newsletter on a monthly basis; another group receives it less/more often. You can then compare to see which one performs better.

Showcasing Team Expertise

Financial planning is a highly relational business, and clients like to be reminded of the human face behind your brand. Your newsletter is a great opportunity to showcase your team, share your company culture and make your business more relatable.

Try to avoid “stuffing” your client newsletter with lots of team members. A better idea might be to run a “staff spotlight” in each edition, where they talk about their past experiences and interests.

Alternatively, in each edition, a new team member could put forward a thought leadership article to demonstrate their competence and knowledge on key topics which are relevant to clients.