As a financial planner, SEO (Search Engine Optimisation) is pivotal in establishing a trustworthy online presence and attracting potential clients.

It is incredibly valuable to appear high up in your users’ search engine results pages (SERPs). Not only does it reassure them that your website is good quality (since many people “trust” the top results), but it also provides a steady stream of engaged visitors to your financial adviser website.

Yet, how can you best use your SEO efforts to increase the likelihood of attracting qualified leads who are actively seeking financial guidance? Below, we explain how to build a viable SEO strategy for financial advisers.

Understanding the Unique Challenges of SEO in Financial Planning

Financial advisers’ SEO will present distinct challenges that require a nuanced approach. There are strict rules about what information can be published online within financial services – e.g. via blogs and landing pages.

Also, financial planning topics can be complex, requiring carefully-crafted content creation. This needs to be “deep” enough to offer value to readers. Yet, not too complex, since this could alienate your audience who may not understand the jargon.

There are also constantly evolving industry trends and market dynamics to contend with in financial advisers’ SEO. Therefore, your SEO efforts need to stay agile to keep your articles and other publications up to date.

How Online Visibility Helps Financial Planners

In today’s digitally driven world, it is vital that a financial adviser (or planner) keep up with modern technology to enhance their reach and visibility to their target audiences.

Financial marketing, such as SEO, helps financial firms engage with their audience, share valuable insights, and build trust over time. By sharing valuable content, you can also build your perception of authority and expertise within the industry.

Offering helpful insights which address your client’s “pain points” will also enhance your image as a trusted adviser and thought leader in your respective niche(s).

Ultimately, search engine optimisation is one of the best ways for a financial adviser to position themself as a go-to expert in the field, driving business growth and success.

Niche Targeting: Tailoring SEO Strategies for Financial Planning Services

If you try to rank your website for almost every possible Google keyword, you will certainly spread yourself too thin with your SEO efforts. Instead, consider focusing on your specific niche(s).

For example, perhaps you are a financial adviser who specialises in helping doctors, armed forces personnel or British expats. Each of these groups will contain unique demographics, preferences and pain points which your marketing can address directly.

This all helps with building your thought leadership. An expert in “everything” is, arguably, an expert in “nothing”. Yet an expert in a niche field of financial services can realistically build up their authority, resulting in stronger client relationships and loyalty.

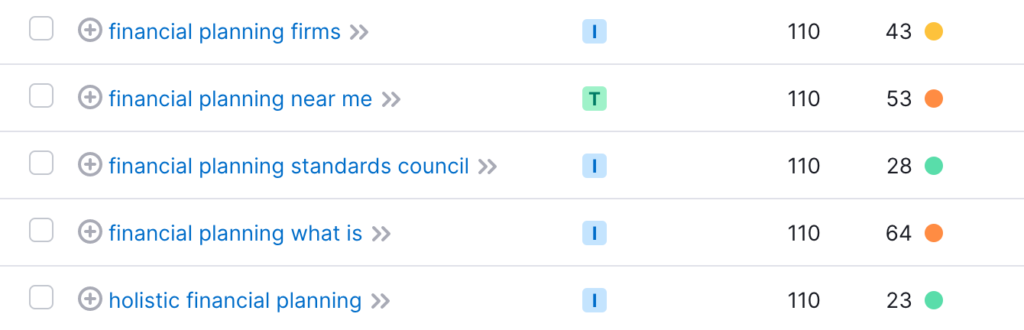

Keyword Research for Financial Planning: Identifying the Right Keywords

How can you include the relevant keywords in your marketing strategy for search engines? Here are some tips to help you draw more organic website traffic:

- Brainstorm relevant topics. What sorts of financial “issues” are your clients facing? Think about questions they ask about retirement planning, investment strategies, and budgeting.

- Long-tail keywords. Short keywords in Google are more likely to be very competitive and difficult to rank for. Rather, consider longer phrases that could give you a better chance of appearing in search results (e.g., “How to save for retirement at 40”).

- Analyse competitors. What are your rivals doing to build their search engine rankings? Find out what is working for them and determine whether you can do it better.

- Use a trusted research tool. There are some amasing digital solutions available which can help you identify financial adviser SEO keywords. Consider trying one or two out to “deepen” your insights into the search engines and what your audiences are looking for online.

On-Page Optimisation for Financial Planning Websites

Google will examine your financial adviser website to check that it meets its criteria before displaying it higher in search engines. This is where “on-site” SEO plays an important role.

This involves multiple steps. For instance, optimising your meta tags, including titles and descriptions, is a good idea to signal to search engines and potential visitors what a page is about.

Integrating multimedia elements – e.g. videos and infographics – both enriches the user experience and provides additional opportunities for keyword optimisation.

Finally, consider structuring your content with headers (H1, H2, etc.). This improves readability for users and helps search engines understand the hierarchy.

What are Off-Page SEO Tactics for Financial Planners?

“Off-page” SEO refers to the “non-website” tactics you can use to boost your website’s organic search presence. A primary example of this is backlink building.

Here, the marketer tries to encourage other authoritative websites to point their hyperlinks back to the financial firm’s website. For instance, perhaps a financial news editorial piece includes a link to a blog post by a financial planner to support the author’s point.

This helps the financial planner by expanding their reach to a wider audience. It also signals to Google that your website is more trustworthy and, therefore, more worthy of higher rankings.

Be careful not to “spam” your website with backlinks, however. Google is very good at spotting when a website owner has simply paid someone to post lots of links on various spammy or low-quality websites. It is better to have fewer, high-quality links than lots of poor-quality ones.

Content Marketing Strategies for Financial Planning: Creating Engaging Content

“Content is king” with search engine optimisation. Without helpful, valuable articles and publications on your website, your SEO strategy is going to struggle. Here are some ideas for creating engaging content:

- Use storytelling. Consider including real-life examples, case studies or client success stories in your content. This makes your articles far more interesting to read and unique.

- Address FAQs. What do your clients typically ask you about? What are some common questions in Google? These can be invaluable for helping you find relevant keywords to boost your website traffic.

- Include educational content. Users appreciate it when financial advisers offer helpful “tips” and “insights” without expecting something in return. Here, you could try publishing informative articles, guides and tutorials to boost your readers’ financial education (building trust in you during the process).

- Identify audience needs. Take time to truly understand your target audience’s financial concerns, goals and questions. Then, build your content around these.

Leveraging Local SEO for Financial Planners

Many financial planners want to build a local client base. Incidentally, many clients want to work with a nearby financial adviser too! So, how can you attract more clients within your geographic vicinity?

Take time to optimise your Google My Business listing to include accurate information about contact information, business hours and service descriptions.

Also, make sure you include location-specific relevant keywords throughout website content, meta tags, and headers (where appropriate). You might want to refer to local cultural icons, landmarks, towns, and villages to signal your affinity for the area.

Finally, take time to gather and publish positive reviews and testimonials from satisfied clients on platforms like Google, Yelp and industry-specific directories (e.g. Unbiased and VouchedFor).

Mobile Optimisation for Financial Planning Websites: Ensuring Accessibility

Google is increasingly looking for financial advisers with websites that are usable across a wide range of devices. Increasingly, users prefer to browse using their smartphones and tablets.

SEO for financial advisers needs to account for this trend. Firstly, make sure that your website is responsive and displays correctly on smaller screens.

A total redesign is sometimes necessary for older websites to ensure mobile-friendly design elements such as easy-to-read fonts, clear navigation menus and properly sised buttons.

Make sure you invest in a fast-loading website, too. This is especially important for users on mobile devices who easily get frustrated with slow-loading pages.

Technical SEO: Optimising Site Structure and Performance

How can financial advisers ensure that their websites are easy to navigate, quick to load and have stable functionality? Here are some points to consider with your web developer:

- Keep “HTTP requests” to a minimum by cutting out needless images, scripts and stylesheets.

- Enable browser caching to store frequently accessed resources locally (in the user’s browser). This helps to increase load times if the user returns to your website later.

- Compress images and files to reduce their size without losing quality.

- Use a content delivery network (CDN) to distribute website content across multiple servers, improving load times for users worldwide.

Building Trust and Authority: Strategies for Financial Planning SEO

It takes a lot of trust for a client to work with a financial adviser. The profession does not always have a good reputation, and the stakes are high when you are dealing with an individual’s life savings.

SEO for financial advisers is a powerful tool for building trust with prospects – especially during the early stages of their “buyer journeys” when they are just getting to know your brand.

Appearing credible, knowledgeable and caring is crucial for reinforcing credibility. Here, it can help to weave case studies, client testimonials and success stories into your content.

Engaging with the online community and participating in digital industry events can also be beneficial. This all reinforces a sense of transparency and trust with clients.

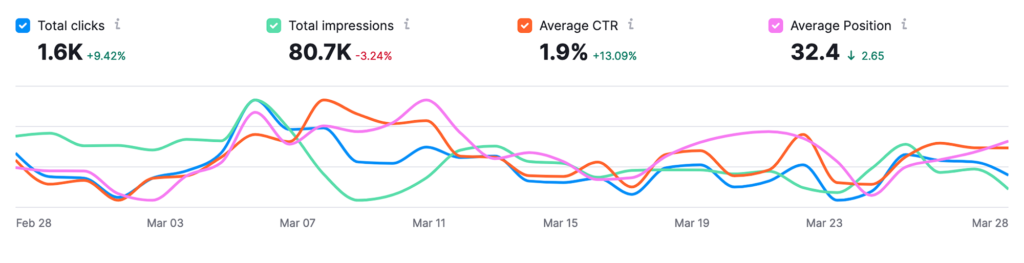

Measuring Success: KPIs and Metrics for Financial Planning SEO

How can you tell if your search engine optimisation is succeeding? A robust measuring plan can help you monitor your “key performance indicators” (KPIs) and relevant keywords.

Organic traffic is a natural KPI to consider. Is this increasing, decreasing or flatlining over time? Also, consider how this traffic is behaving. Are users “bouncing off” your website quickly, or are they staying around to browse and consume your content?

It also helps to have a reliable software system to track your keyword rankings over time in the search engine. This tool will also help you with keyword research and planning. Here, ask yourself: “Is my visibility going up over time, or down?”

Finally, financial advisers can also consider “conversion metrics” such as downloads (e.g. PDF guides) and contact form submissions on your website.

How to Use Case Studies in Successful SEO Campaigns

Client case studies are great for giving tangible evidence of the planner’s expertise and effectiveness in helping clients achieve their financial goals. Yet they also help in SEO for financial advisers.

Financial advisers can cleverly boost their search engine rankings and attract more organic traffic by incorporating relevant keywords and phrases into case study titles, headings, and descriptions.

Financial advisers can also boost their “off-site SEO” by sharing these case studies on social media, industry forums, and other online financial publications. These websites might link back to your own – thus providing some powerful opportunities for backlink building.

Social Media Integration for Financial Planning SEO

One of the ways that social media helps SEO for financial advisers is that it provides more opportunities for backlinks. Here are some ideas to boost your social media integration with your SEO strategy:

- Establish professional and credible social media profiles on the relevant platforms. Make sure these are well-designed and have a realistic chance of reaching your target audience(s).

- Share valuable content. This might include content written by you or others that you think clients might find helpful.

- Use hashtags. Be careful not to just pluck these out of the sky. Do some research and find out which relevant hashtags are currently trending that you could “piggyback” on.

- Engage in cross-promotion by sharing links to your website’s blog posts, guides, and resources.

Future Trends in SEO for Financial Planning: What to Watch For

Search engines are constantly evolving. Make sure your SEO strategy is prepared for future changes in technology and user behaviour to maximise your search engine rankings.

One prominent trend is the increasing importance of voice search optimisation. Today, it is possible to use a search engine without typing anything at all. Simply talking to your device can bring up results!

As such, consider how you can tailor your website content for natural language queries. For instance, include long-tail, conversational keywords and make sure you provide concise, informative answers to common financial questions.

SEO for financial advisers should also account for the rise and potential impact of artificial intelligence (AI). These solutions can help identify trends and patterns in search engines and user behaviour, opening up more opportunities to develop more effective SEO strategies.

AI-powered chatbots and virtual assistants may also play a role in the future of financial websites. However, this new technology still needs to resolve many legal and regulatory issues and consider market dynamics.

For instance, in March 2024, Google released a “core update” which aims to reduce spam in search engines. This appears to be partly driven by the rise in AI-generated content which Google deems below its quality standards.

Common Mistakes to Avoid in Financial Planning SEO

SEO for financial advisers involves a lot of “spinning plates”. As such, it is easy to drop one and make a mistake. Fortunately, many of these can be avoided and quickly corrected.

Be careful not to neglect local SEO optimisation. Remember, Google does not really provide a single search engine for everyone. Rather, it offers a personalised one for each user – tailoring search engine results based on variables such as location, preferences and past search history.

A financial adviser can account for this using keyword research – targeting local keywords and optimising their Google My Business listings.

Also, avoid “black hat” tactics that can hurt your search engine rankings. For instance, keyword stuffing or over-optimising website content makes a website look “unnatural” – often resulting in penalisation in the search engines.

Conclusion: Optimising Your SEO Strategy for Online Success

At CreativeAdviser, we often speak to financial planners who hit a “barrier” to growth. Their client referrals were enough to help them expand the business for a while. Eventually, however, other marketing channels are needed to sustain and accelerate this.

SEO is a great option for financial planners to consider. Using keyword research, a firm can increase its visibility, attract qualified leads and ultimately grow its client base.

By staying abreast of emerging trends and avoiding common mistakes, practitioners can position themselves as trusted authorities in the field of financial planning.

Finally, SEO and digital marketing help financial planners reach a wider audience, build stronger client relationships and diversify their marketing strategies.

Interested in exploring our SEO solutions? Get in touch for a free, no-commitment online chat with a member of our team here at CreativeAdviser.