Financial SEO Services – Bringing Clicks to Clients

Today’s fast-moving digital age often requires financial firms to take a nimble, flexible approach to their marketing. Financial services SEO (search engine optimisation) is a powerful string to add to your bow when seeking to thrive in a competitive landscape.

The UK’s financial services sector can be cluttered. Financial SEO services can help you stand out and reach the right audience. Your SEO strategy can be invaluable in making your brand “voice” audible to prospects within a crowd of online voices.

Below, we explain how financial services SEO works, how to get started and some common errors to avoid when navigating the search engines.

Understanding the Basics: What is Financial SEO?

SEO for financial services involves helping a financial services firm make itself more visible in search engine results pages (e.g. Google). The ultimate aims, after this, are to generate more organic traffic to the company website and generate “conversions”, such as contact form submissions.

Unlike “old school” advertising, which relies on paid placements, financial SEO concentrates on optimising various elements of a website to improve its performance in search engine results pages (SERPs). This involves a range of SEO efforts, such as:

- Keyword research

- Content creation

- Technical SEO enhancements

- Off-page SEO

A financial services company can attempt an SEO strategy independently or with an external partner (e.g. a marketing or SEO agency).

The Importance of Online Visibility in Finance

“Online visibility” refers to how easily users can find a financial services company on the internet. It directly influences a firm’s ability to attract and retain clients in today’s digital age.

Many consumers now turn to the internet to research financial products, services and providers before making a purchasing decision. You hold a distinct competitive advantage if you can position your brand in front of these prospects, above rivals in the search engines.

Not only does online visibility increase your brand awareness, but it also instils confidence in potential clients. Subconsciously, they think: “If this financial services provider has convinced Google to place its website high in its rankings, it must be pretty authoritative and trustworthy.”

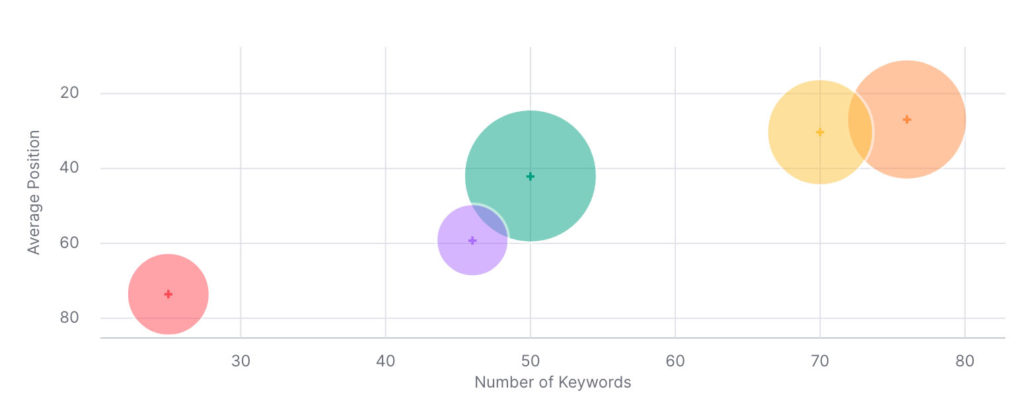

Number of keywords in the top 10 compared to your competitors.

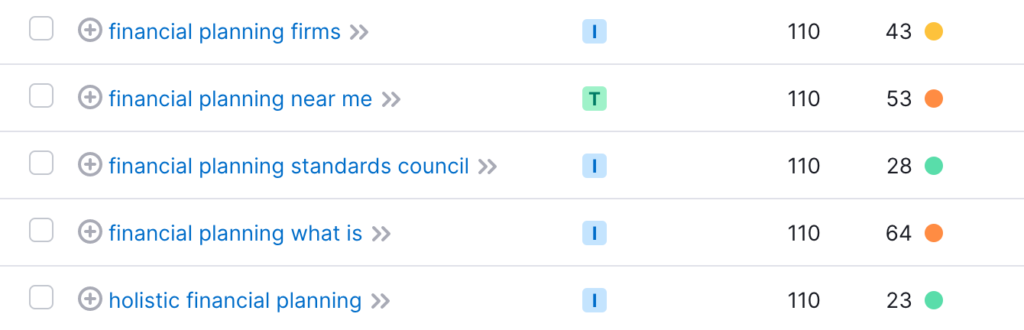

Targeting the Right Keywords

An SEO strategy cannot succeed without targeting appropriate keywords in the search engines. For instance, if a small financial planning firm goes after highly competitive keywords also targeted by large financial institutions (which have bigger marketing “war chests”), it is likely to be out-competed.

A good rule of thumb is to prioritise keywords which are:

- High in relevance

- High in monthly search volume

- Low in competition

- High in user intent

For instance, a small financial planner targeting a generic search term like “ISA” may not benefit much. Users may be searching for all kinds of reasons (seeking financial advice is likely to be a minority), leading to low user intent. The competition will be high, and arguably, the keyword is not as relevant as other candidates.

By contrast, certain “local keywords” may be more suitable in certain cases of financial services SEO. Although the overall search volume will be lower than “ISA”, the user intent and relevance are likely to be higher.

Competition may also be lower. These factors all help to increase the firm’s chances of ranking on page 1 of Google with their SEO efforts.

Leveraging Local SEO for Financial Services Companies

Search engines like Google, in a sense, offer multiple search engines to users. For instance, when you type in a phrase such as “first moon landing”, you are likely to receive global search results (in English). If you search for “next UK election”, the results will be primarily national.

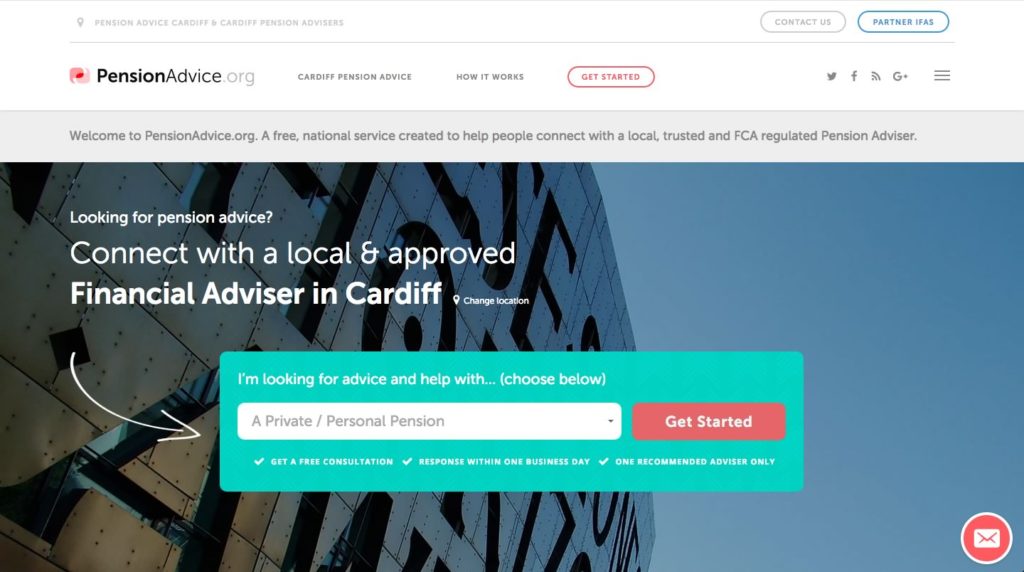

If you search for “financial planner near me”, most results are likely to be local. Local SEO is very important for firms in the financial services sector which aim to grow market share in their geographic area. You can often tell if a search term requires a local SEO strategy when search results include multiple, local Google My Business (GMB) listings.

In 2024, Google often features the “top three” GMB profiles (as “snippets”) for the user’s keyword. Underneath, a grey tab labelled “More Businesses” can take the user to more local businesses if they want to see more options. However, getting into the top 3 is a great local SEO goal for firms seeking to maximise their local online visibility.

A good place to start is to make sure your GMB profile is accurate and up-to-date. Consider including high-quality videos and images of your team and offices. Also, consider gathering positive reviews from clients to achieve a 4-5 star average rating. These all send positive “local SEO signals” to Google!

Staying Ahead of Algorithm Changes

Google and other research engines regularly update their algorithm to improve the user experience (UX). Working with an SEO agency which specialises in financial SEO services can help you stay ahead of these changes and adapt.

However, what can firms do independently to protect their SEO campaigns? One idea is to continually engage in keyword research. Are users changing their behaviour and user intent online? Are keywords changing in popularity?

Financial services SEO also involves taking a regular “SEO audit” to check the overall “health” of your website. Check your technical SEO (i.e. “on-site” efforts like H2 tags and alt tags for images). Also, check your off-page SEO, such as the quality and quantity of backlinks from other websites to yours.