Are you interested in search engine optimisation (SEO)? Many financial firms are looking to build a robust online presence and stay competitive in the digital space. Yet how do you get started?

Building visibility in the search engines takes time, skill and investment. To navigate the process effectively, it is worth thinking about getting help from a financial SEO agency.

It is possible to do a lot of SEO yourself (“DIY SEO”). However, you can make faster progress and avoid common mistakes if you get professional help. Below, we explain the role of financial SEO services and how a specialist agency can add value to your marketing.

Introduction to Financial SEO: Understanding the Basics

At its core, financial services SEO involves optimising your digital content (especially your website) to boost your online visibility to your target audience.

It is a delicate ongoing process which brings together keywords, content quality and technical optimisation to draw more “organic traffic” (i.e. traffic coming from unpaid search engine results).

The end goal is to increase your rankings on search engine results pages (SERPs) to draw in qualified visitors who perform “conversion actions”. These might include downloading your PDF guide, booking to attend your upcoming pensions webinar or filling out your contact form.

Why Financial Services Need Specialised SEO

Arguably, the biggest currency in financial services marketing is trust. The stakes are high with your target market. For a financial planner, for instance, you are dealing with a client’s life savings.

Therefore, considerable work is often required throughout a prospect’s “buyer journey” to build trust in your brand. It is often said that it takes around seven touch points with a brand before a new customer is willing to buy. For financial services, it is likely more.

This is where financial services SEO can help. By offering valuable content “up front” to prospects (and demanding nothing in return), a financial firm can help people address their “pain points”. Seeing results and hearing your expertise builds trust in your brand, and they come to see you as an authority.

However, SEO in the financial services sector can be challenging. Not only are many online marketplaces highly competitive but there are complexities to navigate – such as compliance requirements and intricate jargon. Here, a specialist financial SEO agency can help.

The Role of an SEO Agency in the Financial Industry

Why choose a financial SEO agency rather than just a generic SEO agency? Here are some key points to consider as you weigh up different options:

- A generic agency may not understand financial products, services and processes. As such, financial firms often find themselves funding a learning curve (especially when writing articles). A dedicated agency will not have this issue.

- A specialist will know which keywords to look for. We remember once talking to a small financial firm that had worked for a long time with an agency trying to rank their website for the keyword “ISA.” This was far too competitive for the company. A financial SEO agency will have a deeper insight into which keywords are appropriate and realistic to try to rank for.

- A specialist will be mindful of compliance. Whilst a specialist agency may not offer its own in-house compliance solution (financial firms often prefer to use their own), its writers will be very experienced in crafting content which broadly fits the bill. A generic agency may find itself often falling over its words within the strict regulatory landscape.

Choosing the Right Financial SEO Agency: Key Considerations

Just because an agency is a specialist in your industry does not necessarily mean it is the right fit for your business. Search engine optimisation is a long-term commitment, so you need to ensure a productive partnership.

Check for expertise in the financial sector. What is the agency’s track record? Do they clearly understand your industry’s nuances, compliance requirements and target audience behaviours?

Look for transparency and clear communication. Technical SEO, for instance, uses a lot of jargon and can be difficult for many people to understand. Does the agency go out of its way to help you grasp what you need to know before committing to an SEO strategy?

A good sign of this will be regular updates, reports, and insights (e.g., on their blog), which demonstrate a commitment to keeping clients informed about their campaign progress.

Tailoring SEO Strategies for Financial Services: Best Practices

SEO in financial services requires a nuanced approach that considers the industry’s unique characteristics, compliance requirements and the specific needs of target audiences. Here are some best practices to consider:

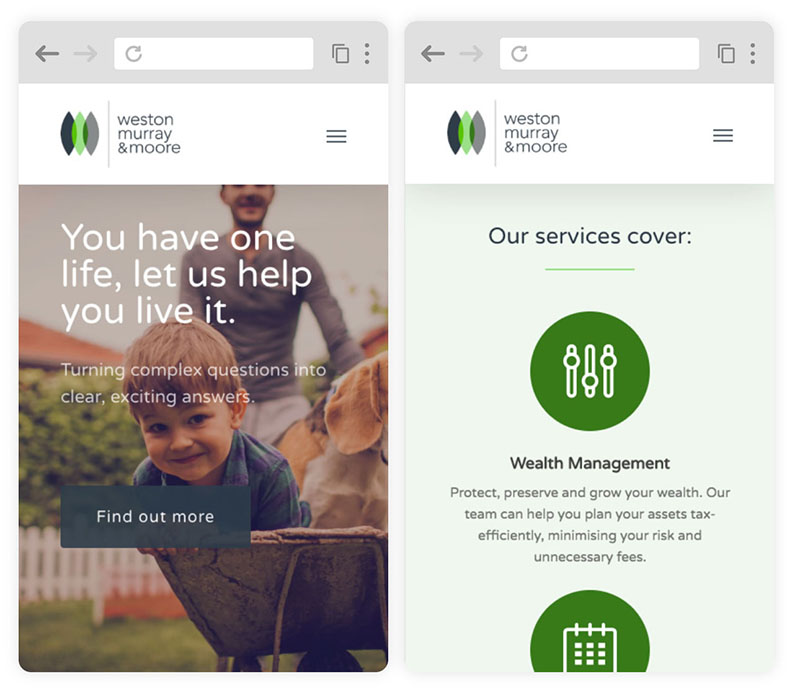

- Optimise for mobile by ensuring responsive web pages and fast loading speeds on smartphones and tablets.

- Conduct in-depth keyword research to identify relevant terms and phrases your target audience uses. A financial SEO agency can give you an edge by using its industry knowledge and dedicated software to help “unearth” data-driven insights for your SEO strategy.

- Build content for long-tail keywords. These might include questions that people type into the search engines. These are often easier to rank for and are ideal for blog posts (providing answers).

- Draw in a steady stream of high-quality backlinks from other authoritative websites. This helps to build your “domain authority” and signals to Google that your website is a trusted source for users.

Building Trust and Authority: Strategies for Financial SEO

Offering content that demonstrates industry knowledge, addresses common financial concerns, and provides actionable insights is a great starting point.

By focusing on providing value to potential clients rather than making a sale, financial services reassure prospects that they have their best interests at heart.

Another powerful strategy is to use client case studies, testimonials and success stories in your content. Third-party validation is especially important in financial services since prospects want to see tangible evidence that you have helped people like them in the past.

Finally, consider including backlinks in your SEO strategy. If other trusted websites and blogs link to your own, it reassures prospects that you are credible and authoritative.

Leveraging Local SEO for Financial Firms

Many financial firms—such as independent financial advisers—are small, locally-based businesses looking to build up a client base in the local area. How can financial SEO services help you?

Here, local SEO can be very powerful. Many search engine results are tailored to users based on their current geographic location. For instance, if a user searches for “financial adviser near me” as they walk through the streets of Oxford, then their smartphone should provide a list of firms nearby.

Consider investing in your Google My Business listing to boost your visibility in these search results. Make sure that your NAP (Name, Address, Phone Number) is accurate and consistent. Try to build some positive reviews from clients.

Take time to research location-based keywords and incorporate geographic modifiers into your website content and metadata. Using location-specific landing pages can also enhance local SEO.

Content Marketing for Financial Services: SEO Tips

How can you make your technical SEO, local SEO and wider strategy most effective – especially regarding its “content component” (e.g. articles and guides)? Here are some tips:

- Focus on the user experience. Make sure your organic traffic has an easy time navigating (e.g. using the menu). Also, prioritise fast loading speeds and mobile responsiveness.

- Optimise your “on-site SEO.” This involves naturally including your target keyword(s) in the titles, headings, meta descriptions, and body text.

- Develop high-quality content that addresses your audience’s “pain points.” Search engines tend to reward SERP content that provides readers with valuable insights and solutions.

- Include multimedia elements such as videos, infographics and interactive tools to engage users and enhance SEO.

Measuring Success: KPIs for Financial SEO Campaigns

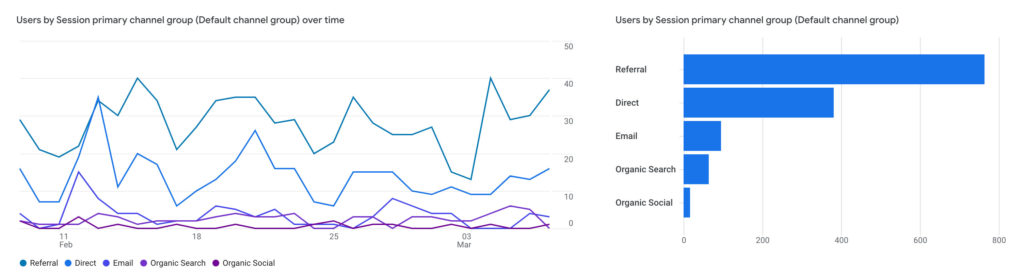

One crucial KPI (key performance indicator) is organic search traffic. This shows the volume of visitors to your financial website from search engine results pages (SERPs). Is this going up or down over time?

Another useful KPI is “online visibility” in the search engines. This is often represented as an aggregate figure (e.g. your total change in position for each keyword divided by the total number of keywords). Here, is your average position rising or falling?

Perhaps the most important KPI for financial services is conversions. For instance, how much of your organic traffic downloads your PDF guides, books online meetings or fills out your contact form?

Integrating Social Media into Financial SEO Strategies

Social media platforms can be useful ways to increase the reach of your content (e.g., by sharing blog posts with followers), engage with your audience and drive website traffic.

They can also help with building backlinks to your website. As more people see your content, other industry professionals, influencers and website owners might share it and point people back to it – perhaps via links on their own blog posts.

Social media engagement metrics (e.g. likes, shares and comments) can also provide valuable insights to financial services into the effectiveness of SEO strategies in engaging the target audience.

For instance, if a campaign is working on Facebook, could any lessons be applied to your SEO?

Conclusion: Maximising Your Online Presence Through SEO

SEO is a powerful tool for helping financial services firms stay competitive in the digital landscape and reach their target audiences effectively. Moreover, a dedicated agency can facilitate these efforts.

A specialist can assist the finance industry with technical SEO, keyword research and bespoke SEO strategies – helping firms reach potential customers by building their presence in search results.

Building search engine rankings is a complex ongoing process. It takes a lot of time and attention. Having an experienced agency to help you with the strategic planning and legwork will take a lot of pressure off your own internal resources.

Interested in discussing your SEO strategy? Get in touch today to arrange a free, no-commitment online chat with a member of our team and enjoy a free SEO audit.