Branding is vital in many sectors. It helps consumers to distinguish a business and its products/services from others, building a set of expectations about quality and customer experience. For a financial firm, branding is essential for helping to forge trust with new prospects as well as loyalty and advocacy from your existing clients.

However, branding can be difficult to understand as an abstract concept with many facets. What is it exactly? How can you build a strong financial services logo and brand? Below, our team explores these questions in more detail.

We hope these ideas are useful to you. Please get in touch with us for more information or to book a no-commitment, free marketing consultation with us.

What is financial branding?

Your brand encompasses the story and identity of your financial services business. A famous example is Downlands Cancara, the famous English-graded Trakehner stallion, which came to represent Lloyds Bank in a series of TV adverts from the late 1980s.

Naturally, the image evokes a sense of tradition, strength, prestige and quality (“good breeding”). TV adverts over the years have also represented the horse as beautiful and graceful, symbolising freedom as it runs along hillsides and beaches.

A black horse is also a brave symbol for a bank to choose since it can represent danger, mystery and fear of the unknown – even death. Yet the choice of image styling largely overcomes these perceptions, the horse’s speed (showing an overcoming of obstacles) and mingling amongst human beings (representing care and belonging).

This example starts to show what financial branding is about, at its core. Yet, it goes beyond one single image or logo design. It encompasses the company name, wider visual identity (e.g. colour scheme) and set of experiences which audiences have come to expect.

The foundations of a strong financial brand

One of the core principles of branding is to be consistent. If people do not have a similar experience across all “touch points” with your business, it is unsettling and confusing. They will struggle to remember you and what you stand for.

Think about McDonalds and the famous Golden Arches. Regardless of where you go in the UK, you know what to expect when you drive into a restaurant. The menu is the same. The buildings look broadly similar from the outside and the interior design (seating, tables and counter) is consistent across different sites.

Naturally, a financial firm will want to create a customer experience that is very different from a fast food chain. Yet the principle is the same. For instance, does the client (or prospect) get the same overall “look and feel” from your website, office interior and printed marketing materials?

Do your staff share a common “brand language” when answering the phone or writing emails? This is not to say that your team members cannot have their own voice or personalities. However, all spoken and unspoken communications, external and internal, should be consistent with your chosen visual identity, business identity and brand values.

That latter point is also vital to generating consistency – values. What does your financial firm “stand for”? Which ideals does it rally everyone behind? Many businesses in this sector make mistakes here. They talk about “quality” or “always putting the client first, ” for instance. Whilst these values are important, they are not unique. Most other firms say the same thing. As a result, your brand voice can get drowned out in the marketplace.

Think hard about making your brand values sound different – even if they ultimately get at the same ideas as your competitors. Let’s take Virgin as an example. Despite operating across many industries, the group has still managed to identify six brand values which are memorable and distinctive. “Straight up”, for instance, is another way of saying “honest” or “truthful”; yet it has far more personality than choosing either of those two words.

The relationship between branding and business success

In the competitive landscape of financial services, branding is not just about logos and taglines; it’s the embodiment of your firm’s values, ethos, and the promise you make to your clients. A well-crafted brand strategy acts as a beacon, guiding potential clients through the noise and directly to your door. It’s a powerful tool for differentiation, enabling financial firms to distinguish themselves from competitors in meaningful ways.

Effective branding creates a memorable impression and fosters trust. In an industry where trust and reliability are paramount, a strong brand can significantly impact customer loyalty and retention. It communicates stability, reliability, and expertise—key attributes that clients seek in financial service providers. Furthermore, a cohesive brand strategy aligns all aspects of a firm—from its digital presence to customer service—ensuring a consistent and positive client experience.

Why is branding important in financial services?

Branding in financial services transcends mere aesthetics. It’s a critical component of a firm’s identity and plays a pivotal role in its success. Here are several reasons why branding is indispensable in the financial sector:

- Trust and Credibility: In an era where consumers are increasingly sceptical of financial institutions, strong financial branding can serve as a mark of credibility and trust. It reassures clients that they are engaging with a reputable and secure entity.

- Differentiation: With countless financial services companies offering similar services, a distinctive brand helps your firm stand out. It highlights your unique value proposition, drawing attention to the specific benefits clients can expect when working with you.

- Client Loyalty: A compelling brand resonates with clients on a personal level, encouraging emotional connections that foster loyalty. It’s not just about the services you offer but how you make your clients feel that counts.

- Market Positioning: Your brand defines your place in the market. It articulates who you are, who you serve, and why you’re different. This clarity is essential for attracting your ideal clients and establishing your firm as a leader in its niche.

- Employee Engagement: A strong brand doesn’t just attract clients; it also attracts top talent. When employees feel aligned with a brand’s values and mission, they are more engaged, motivated, and committed to delivering exceptional service.

Building a strong financial services brand requires a strategic approach that encompasses understanding your target audience, defining your unique value proposition, and consistently communicating your brand message across all touchpoints. It’s about creating a narrative that connects with clients, reassures them of your expertise, and builds lasting relationships based on trust and value.

In crafting your brand, consider what sets your firm apart, the values that drive your business, and how you can communicate these elements effectively to resonate with your audience. Remember, your brand is more than just your visual identity; it’s the total experience you offer to your clients and the emotional response it evokes.

Embracing the power of branding in the financial services industry is not just beneficial; it’s essential for survival and growth in an increasingly competitive and dynamic market. By prioritising your brand, you pave the way for enhanced visibility, credibility, and success.

How do you create a financial brand?

Creating a financial brand requires a strategic approach that merges market understanding, customer insights, and clear differentiation. Here’s a step-by-step guide to crafting a financial brand that not only stands out but also resonates deeply with your target audience.

1. Define Your Brand Identity

Start by articulating what your brand stands for. This includes your mission (why your firm exists), vision (what you aim to achieve), and values (the principles guiding your actions). These core elements form the foundation of your brand identity, shaping how you present your firm to the world.

2. Understand Your Target Audience

Knowing your audience is crucial. Conduct market research to understand their needs, preferences, and pain points. This insight allows you to tailor your brand message and services to meet their specific requirements, making your brand more relevant and appealing.

3. Develop Your Unique Value Proposition (UVP)

Your UVP is what makes your firm different and better than the competition. It should clearly articulate the unique benefits your clients receive by choosing your services. Whether it’s unparalleled expertise, innovative solutions, or exceptional customer service, your UVP should be compelling and distinct.

4. Craft Your Brand Messaging

Your brand messaging is how you communicate your brand identity and UVP to your audience. It should be clear, consistent, and engaging, reflecting the tone and personality of your brand. Whether it’s through your website, marketing materials, or social media, your messaging should consistently convey who you are and why you matter.

5. Design Your Visual Identity

Your visual identity includes your logo, colour scheme, typography, and other visual elements that represent your brand. These should align with your brand’s personality and appeal to your target audience. A professional and cohesive visual identity helps make your brand memorable and trustworthy.

6. Build a Strong Online Presence

In today’s digital age, a robust online presence is essential. This includes a user-friendly website, active social media profiles, and a content marketing strategy that provides value to your audience. Your online platforms should reflect your brand identity, communicate your UVP, and engage with your audience effectively.

7. Deliver Exceptional Customer Experiences

Your brand is also defined by the experiences you provide. Strive to exceed client expectations at every touchpoint, from initial contact through to after-sales support. Positive experiences reinforce your brand promise and build loyalty.

8. Foster Brand Advocacy

Encourage satisfied clients to share their experiences with others. Word-of-mouth referrals and testimonials are powerful endorsements of your brand. Create a referral program or leverage social proof to enhance your brand’s credibility and attract new clients.

9. Continuously Monitor and Adapt

Branding is not a set-and-forget process. Regularly assess your brand’s performance, gather feedback, and be prepared to make adjustments. Market conditions, customer preferences, and competitive landscapes evolve, so your brand should remain flexible to stay relevant and compelling.

Creating a financial brand is a comprehensive process that involves deep reflection on what your firm represents, a clear understanding of your market, and a commitment to delivering value at every opportunity. By following these steps, you can build a strong, enduring financial brand that captures the essence of your firm and fosters meaningful connections with your clients.

Invest in a strong brand identity

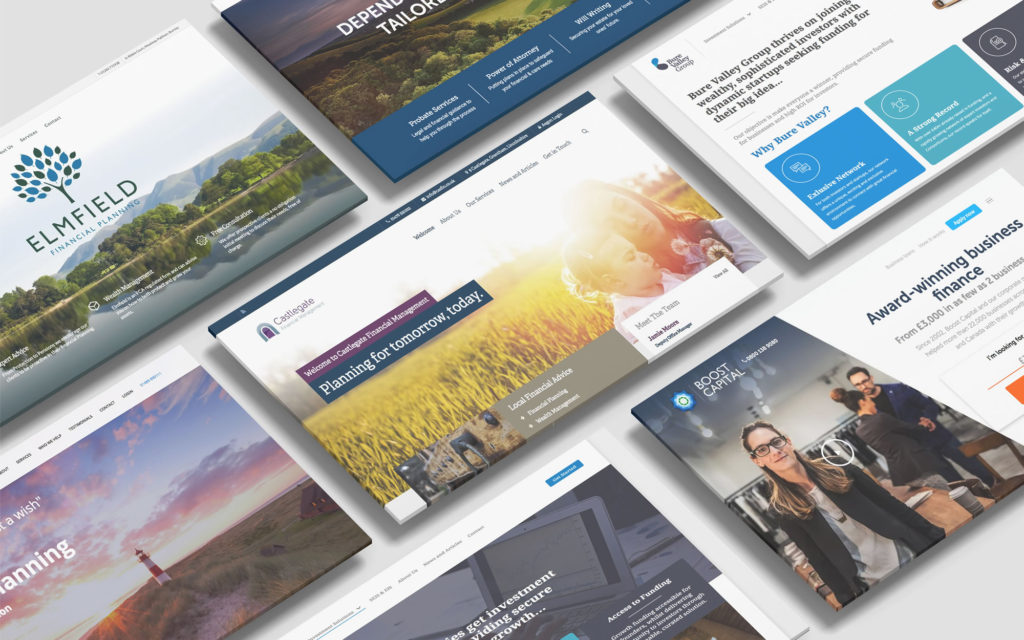

Hopefully, by now, you can see that a lot of strategic thought goes into financial services brands. Yet once your branding strategy is “fleshed out, ” it is important not to skip the design process.

If you cut corners with your logo design, for instance, then clients will almost certainly notice – feeling unsettled. Subconsciously, someone looking at that will think: “If this business cannot invest properly in their presentation, how can I be sure they will invest properly in me?” The good news is that a high-quality visual identity achieves the opposite effect – immediately building reassurance and trust.

Investing in the creation of a visual identity for your financial firm takes time and a trusted pair of hands in your sector. It can take one or even two business quarters to get it completely right. However, once your financial branding is ready, it should stand the test of time. Even if you redesign your website in the future, for instance, your branding can stay consistent.

The branding process can be shorter or longer depending on the depth that you want to go into. For instance, a startup might want to focus on getting a logo, colour scheme and letterhead up and running. A larger, more established firm – able to dedicate more time and resources to a project – may also wish to look at fonts, imagery and brand collateral such as client folders and invitation packs. There are so many possibilities and we’d love to explore these with you!