SEO (search engine optimisation) is one of the best ways for a financial services firm to engage in marketing. It involves positioning your website at – or near – the top of Google search results for specific keywords or search terms that your target audience uses to find solutions like yours. When the user sees your webpage listed there, you hope they can click and visit your website. The ultimate aim is for them to read your content and take some kind of meaningful action (i.e. perform a “conversion”), such as filling out your content form or booking a meeting.

How can you give your financial website the best chance of appearing in the top positions of search results? Below, we list some of the main “pillars” of a financial SEO strategy to consider for 2024. We hope these ideas are useful to you. Please get in touch with us for more information or to book a no-commitment, free marketing consultation.

1. Website speed

How fast is your website to load? If users need to wait a long time when clicking through your navigation, there is a high chance of losing them. Indeed, for each second of improvement to your website speed, there is an estimated 17% increase in the “conversion rate” (the percentage of visitors who take a conversion action).

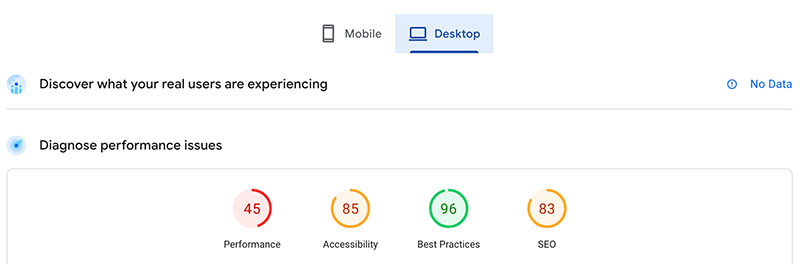

Google recognises that users prefer faster websites. Therefore, the company lists speed as a “ranking factor” in its search engine algorithm. You can check your website speed using a free service called PageSpeed Insights, which gives it a score and highlights areas for improvement.

2. Mobile responsiveness

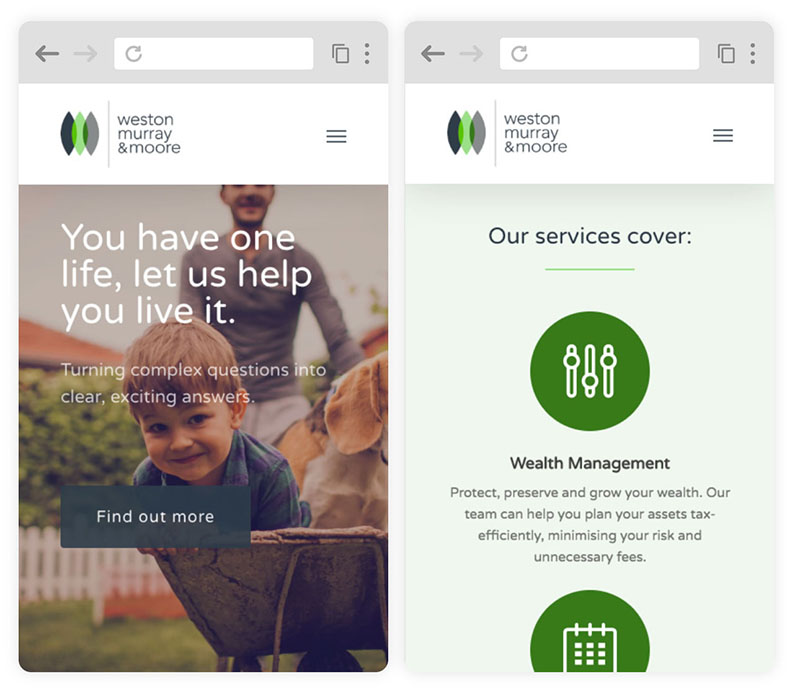

What does your financial website look like on a tablet, mobile device, and other screen sizes? Many websites were designed several years ago, focusing on the popular desktop PCs and laptop screens of the time.

However, increasingly, smartphones are the preferred medium for users to view financial websites. Again, Google knows this and makes “mobile responsiveness” a ranking factor for SEO. This means that your website will likely rise up the search results (all else being equal) if the layout and elements “move around” to fit different screen sizes.

3. Title tags

What kind of headlines are on your blogs? What are the titles of your “core” website pages? These are great places to put your target keywords (if you can make it sound natural). For instance, a financial planner in Suffolk might use “Financial Adviser Suffolk” for their homepage title rather than “Home”. This sends out “local SEO” signals to Google about the specific location of your business, helping your website rank higher in users’ search results if they search for a financial adviser in that particular area.

4. Clean site structure

Is your website large, clunky and difficult to navigate? Does the user have to “dig” through multiple levels of pages to find the specific page or information they want? These websites typically have a poor user experience, leading Google to deprioritise them.

By contrast, a smaller financial website can often perform better if the menu is intuitive and users can quickly find what they need. Each page should also be designed with this in mind. Cumbersome, text-heavy pages are unattractive and difficult to read. However, a page that is “broken up” in a pleasing way (e.g., using subheadings, imagery, paragraphs, and bullet points) can keep the user engaged.

5. Do not forget your meta information

When you type a search term into Google, you will notice a list of titles and accompanying descriptions. These are called “meta” titles and descriptions. They are often forgotten when financial firms publish a new website page or blog. This can hurt your SEO.

However, if you take time to think about the specific words to use (e.g. the target keyword and engaging language which draws the user in), you can increase the chances of your link appearing in the top results – also improving the odds of getting the click, rather than your rivals.

6. Build up your links

Does your website link to any authoritative external websites to support its content? In your blog posts, for example, you could reference trusted sources of information such as .gov and Citizens Advice to reinforce your points.

Over time, doing this can build up your “domain authority” in Google’s eyes – especially if other authoritative websites link back to you (signalling that they regard your content as highly reliable). Consider also reviewing your internal links – i.e. links pointing to other relevant pages on your website – to help drive more traffic and boost your engagement rates.

7. Be quick to address errors

As a financial firm, you will inevitably make “mistakes” with your SEO. Google’s requirements can change over time, for instance, making a previously accepted SEO practice illegitimate. Therefore, it is important to keep track of issues and address them.

A useful tool for this is Google Search Console (previously called “webmaster tools”). By installing the code on your financial website, you can quickly be alerted of SEO problems such as “crawl errors” and put them right.

Conclusion

As we look ahead to 2024, financial SEO continues to be a vital aspect of effective marketing for financial services firms. Optimising your website for search engines can significantly impact your visibility in search results, attracting more visitors and increasing the likelihood of conversions. By following the key pillars of a financial SEO strategy, you can position your website for success in the competitive landscape of digital marketing.

First and foremost, website speed plays a crucial role in user experience and search engine rankings. A faster website not only enhances user satisfaction but also improves conversion rates. Remember to regularly assess your website speed using tools like PageSpeed Insights to identify areas for improvement and maintain optimal performance.

In an increasingly mobile-centric world, mobile responsiveness is an essential consideration. Users rely more on smartphones and tablets to access financial websites, so ensuring that your website adapts seamlessly to various screen sizes is imperative. Google acknowledges the importance of mobile responsiveness and rewards sites that prioritise this aspect of user experience.

Titles and meta information are powerful tools for optimising your website’s visibility. Incorporating relevant keywords in headlines and meta descriptions can improve your website’s ranking for specific searches, enhancing your chances of attracting click-throughs and outperforming competitors. Local SEO signals, such as incorporating specific locations in your titles, can also help elevate your website’s visibility in targeted areas.

While optimising your website’s structure, ensure it is easy to navigate and provides a seamless user experience. A cluttered and confusing site structure can cause frustration and deter users. On the other hand, a well-organised and visually appealing website with clear subheadings, imagery, paragraphs, and bullet points can engage users and encourage them to explore further.

Building a solid network of authoritative external and internal links is instrumental in establishing your website’s credibility and increasing its domain authority. By referencing trusted sources within your content and attracting backlinks from reputable websites, you can enhance your website’s reputation and visibility in search results.

Lastly, maintaining a proactive approach and addressing SEO errors promptly is crucial in this ever-evolving digital landscape. Google’s requirements and best practices change over time, and it’s essential to stay vigilant and adapt accordingly. Utilise tools like Google Search Console to monitor your website’s health and quickly rectify any issues that may arise.

By implementing these key pillars of financial SEO, you can position your website for success and maximise your visibility in search results. Stay informed as the digital landscape evolves, refine your strategies, and adapt to the changing SEO landscape. Contact us for more information or to book a no-commitment, free marketing consultation to explore how we can help you achieve your SEO goals in 2024 and beyond.