Financial services marketers arguably face unique challenges compared to other industries. There are strict regulations, evolving consumer expectations and fierce competition to navigate.

Yet, with the right strategy, it is possible to build a long-term plan to increase brand exposure, generate more leads and boost client satisfaction.

This guide is tailored to provide financial services companies with actionable insights, proven tactics and innovative approaches to elevate your financial marketing strategies in 2024.

The Importance of Digital Platforms for Financial Services Marketing

Traditionally, financial firms have relied on “old school” forms of marketing such as radio, TV and magazine ads to achieve their goals. In 2024, however, the realm of digital marketing arguably holds far more potential.

With the Internet, financial institutions can reach a broader audience beyond your local geographic area. digital platforms are also accessible to consumers 24/7, allowing them to make inquiries and perform “conversion actions” (e.g. on your website) at any time convenient to them.

Digital marketing also often proves to be more cost-effective compared to traditional marketing – e.g. print. Budgets can be invested more efficiently via targeted online advertising, content marketing or email campaigns.

The Role of Content Marketing in Financial Services

Content marketing is a key “pillar” of any robust digital marketing strategy within financial services. This involves creating and distributing relevant, useful content to your target audience.

Here are some ways content marketing can benefit a financial services company:

- It helps you to position your brand as a thought leader and expert in the field.

- It assists with educating your audience about various financial concepts and strategies in a clear and accessible manner. This saves you from having to explain things in person!

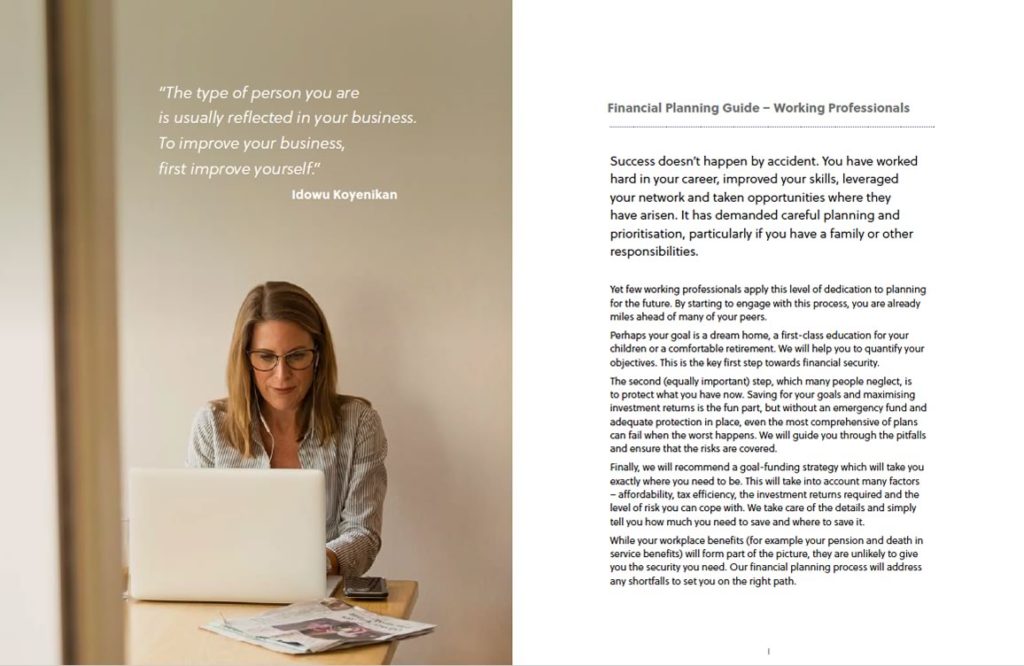

- Valuable content such as guides, whitepapers and webinars can act as attractive “lead magnets” which can generate more leads.

- Relevant, keyword-optimised content can attract organic traffic from search engines.

Targeting the Right Audience: Strategies for Financial Services Marketers

Who are you looking to reach with your financial services marketing strategy? Here, it helps to have a defined “buyer persona” – or ideal description of your target client – ready at hand.

This describes their key demographics and psychographics (e.g. needs and fears), empowering you to speak to them more effectively in your online communications. For instance, are certain readers mainly driven by pension fears and confusion? If so, perhaps you could target your content to that need.

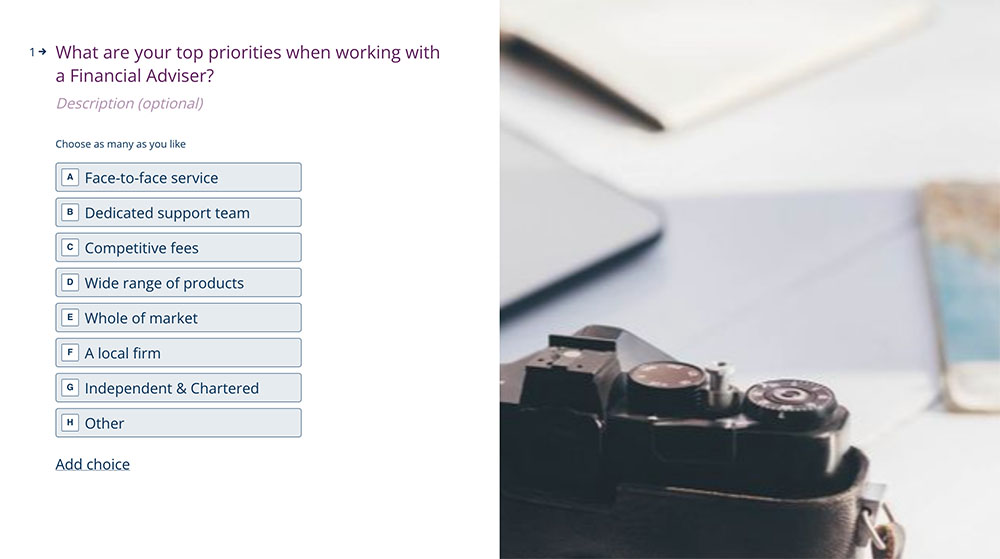

Financial services can use market research techniques to gather information about your specific audience including their preferences, behaviours, pain points and challenges.

You could also consult existing customer data, conduct your own surveys and study industry reports to gain a clearer picture of your target client(s).

Keep testing and iterating your financial marketing strategies to what resonates best with your target audience. A/B testing can help you find out more about how to boost engagement, conversion rates and marketing ROI.

Building Trust and Credibility in Financial Marketing

Financial firms have to pass a high barrier of trust when speaking to new prospects. After all, consumers are entrusting their hard-earned money and financial well-being to your services.

Therefore, it is vital that your financial marketing puts users at ease and alleviates any fears which may prohibit them from progressing along their “buyer journey”. Here are some ideas:

- Provide valuable information without a sales pitch (e.g. blogs, PDF guides and educational videos).

- Feature testimonials from satisfied clients on your website, newsletter and other communications.

- Be up-front about your pricing, fees, terms and conditions so clients are not caught off-guard later.

- Deliver prompt, courteous and knowledgeable customer service at every brand touchpoint.

- Collect and act on feedback.

Optimising SEO for Financial Service Companies

Financial SEO (search engine optimisation) involves boosting the visibility of your website in Google. The ultimate aim is to attract more qualified “organic traffic” which then performs meaningful actions – “conversions” – such as filling out your contact form or booking a meeting.

SEO for financial advisers is an ongoing effort. You cannot “set it and forget it”. The work includes regularly identifying relevant keywords used by your audience and targeting these with dedicated blogs and landing pages.

On-site SEO is also important such as improving your titles, meta descriptions, headers and URL structures. Make sure your website is optimised for mobile devices, loads quickly and is built with up-to-date schema markup.

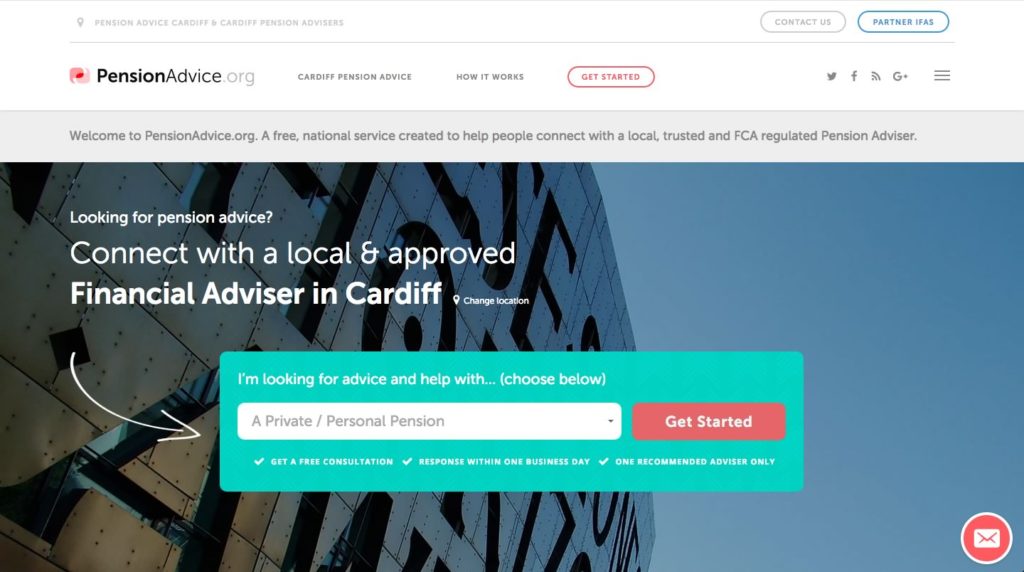

For financial planners and advisers looking to boost their local search presence, consider also building location-specific landing pages, incorporating local keywords and ensuring consistency across online directories and listings (e.g., Google My Business, Yelp, etc.).

Why Effective Landing Pages Matter for Financial Firms

A landing page is a page on your website which is designed specifically for a marketing or advertising campaign. It does not serve a general marketing purpose, like your About Us or Contact Us page.

For instance, your homepage acts as a “shop window” for your financial firm, and it is easily accessible from the navigation bar. A landing page, by contrast, may not be discoverable from the main menu and may serve primarily to appear in Google – trying to attract specific users to the website.

Landing pages allow financial firms to tailor their message to a specific audience or offer. For instance, you might have a dedicated page on pension transfers and another on inheritance tax planning. This focused messaging increases the relevance of each page to visitors, improving the chances of conversion actions – such as downloading a PDF guide.

The Power of Data-Driven Marketing in the Financial Services Industry

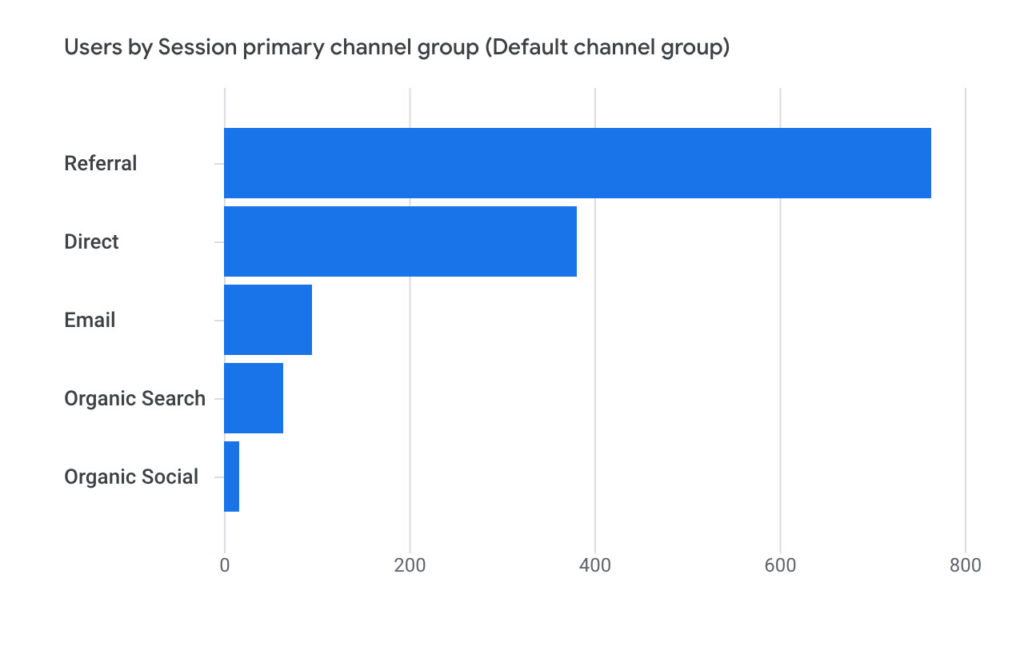

Digital marketing offers financial institutions great power by allowing greater insight into customer behaviour and preferences. You can then use this information to tailor your marketing strategies.

First of all, data-driven marketing allows financial services companies to target and segment their audience more effectively. It becomes easier to identify high-value customer segments and focus your efforts on them.

More data also gives you more insight into customers’ financial goals, life events and purchasing patterns. Financial institutions, such as banks, can then deliver more relevant and timely marketing messages (e.g. through push notifications via their mobile apps).

Data-driven marketing also helps to ensure compliance with regulatory requirements when implementing a financial services marketing strategy. In today’s GDPR-driven landscape, it is even more important to safeguard customer information against unauthorised access or misuse.

Social Media Marketing Tactics for the Financial Services Industry

Financial institutions need to tread carefully when using social media. After all, you do not want to “go viral” for the wrong reasons! However, it can be very powerful in the right hands:

- It can be a useful channel to showcase success stories and testimonials from satisfied customers.

- Facebook Live, Instagram Live and Twitter Spaces could be powerful ways for financial services to engage directly with potential customers (e.g. via live Q&A sessions).

- Social media contests and “giveaways” can boost your engagement and attract new followers.

- Create more intrigue and humanise your brand by sharing photos, videos or stories that highlight your team, office culture and day-to-day operations.

- Boost your reach and interaction with prospects by offering financial planning tools, calculators and quizzes through your social profiles.

Email Marketing Best Practices for Financial Institutions

No financial services marketing strategy is complete without a strong email component. Newsletters, in particular, are great for engaging with customers, nurturing leads and driving conversions.

Segment your email list based on factors such as demographics, interests, financial goals or stage in the customer journey. You can then tailor the content to reflect the needs of each segment.

Avoid misleading or spammy subject lines and try to keep your content informative and valuable (not sales-driven). Offer tips, insights, and actionable advice which your readers will find helpful.

Finally, make sure your email campaigns look the part by including engaging visuals such as images, graphics and branded design elements. Include clear and compelling calls-to-action (CTAs) in all of your financial services marketing to help drive meaningful action, such as referring your content to a friend.

Leveraging User-Generated Content in Financial Marketing

Is your financial services business making the best use of “social proof”? Anyone can say good things about themselves. It all sounds much more convincing when it comes from clients.

Boost your digital marketing by encouraging testimonials, reviews and case studies from current clients who have had positive experiences with you.

Another idea is to invite client participation in content creation. For instance, perhaps you could invite users to share budgeting tips, investment strategies or stories about achieving financial goals.

Financial institutions can also use interactive quizzes, polls or surveys that invite users to share their opinions, preferences or financial goals.

Hosting Webinars and Workshops for Financial Literacy

The financial services industry can be intimidating for clients and prospects because there is so much jargon and complex information. By educating them, however, you can empower them – helping them to make better decisions with money (and crediting you for it!).

Here are some tips on how to include webinars and workshops effectively in your financial services marketing:

- Choose interesting, timely topics which are pressing for your clients (e.g. how does conflict in the Middle East affect my investments?).

- Choose an accessible, reliable and trustworthy platform for your webinar. Some options to consider include Zoom, GoToWebinar, WebEx and Microsoft Teams.

- Include visually-engaging visuals in your presentation such as infographics, charts and imagery.

- Practice your presentation. Rehearse and put yourself in the shoes of the listener when delivering vital self-critical feedback.

- Offer additional resources and materials to participants to reinforce key concepts covered in the webinar or workshop.

Customer Retention Strategies in Financial Services Marketing

Many financial firms rely on long-term client relationships for their business models. In this respect, your financial services marketing can play a key role in deepening those bonds – boosting loyalty and brand advocacy from existing clients.

One simple tip is to be proactive with your marketing strategy. Anticipate customer needs and reach out to offer assistance or support before they ask for it – e.g. via emails, newsletters and other communication channels.

Schedule regular check-ins and consider offering exclusive benefits, discounts or rewards that incentivise client loyalty. Think about how you can improve customer wellbeing through branded tools, resources and support which help customers, for instance, in managing debt or saving for emergencies.

Financial services marketing can also involve hosting events, workshops or online forums which help to build a supportive community.

Crafting a Compelling Brand Story in Financial Marketing

Financial marketing is dull when it is purely informative. To counter potential “staleness” in your marketing strategies, think about how you can engage your clients’ emotions.

One great way to do this is through stories. A compelling brand story makes your business immediately more relatable and less “distantly corporate” (which can seem cold, uncaring and intimidating).

A well-conceived narrative makes your brand more memorable and helps make customers more receptive to your firm’s marketing messages and offerings. This also makes it easier for you to carve out a distinctive identity and position yourself as the preferred choice among competitors.

A brand story is also great for your internal marketing by attracting top talent to your firm. Retention can also be fostered by building a sense of pride, belonging, and fulfilment amongst staff.

Measuring ROI in Financial Service Marketing Campaigns

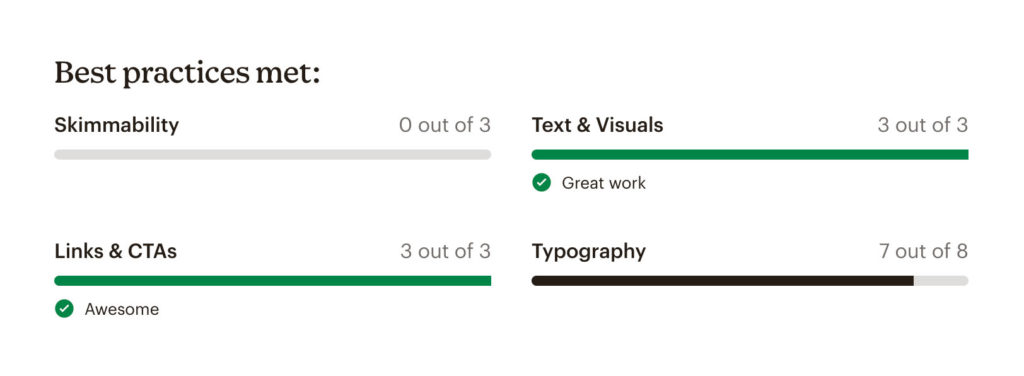

Marketing financial services is not easy. You need to keep measuring how things are performing and make appropriate adjustments when your plan is steering off course.

For key stakeholders in a financial services firm (e.g. directors), the return on investment (ROI) is the bottom line when assessing marketing strategies. Here are some ideas for effective measurement of marketing ROI:

- Use tracking tools such as Google Analytics and ad tracking software to monitor performance.

- Keep a thorough record of marketing costs such as advertising spend, agency fees and software subscriptions. Break down these costs by channel, campaign and marketing activity to understand where your resources are being allocated.

- Track sales, leads, sign-ups or other desired actions that result from your marketing efforts. This will help you to calculate the total revenue from your marketing (later segmenting by channel).

- Use the formula ROI=(CostRevenue−Cost)×100 to work out the ROI of your marketing strategies.

- Weigh up different attribution models to understand the role of each marketing touchpoint in your customer journey.

- Optimise and iterate in light of the results.

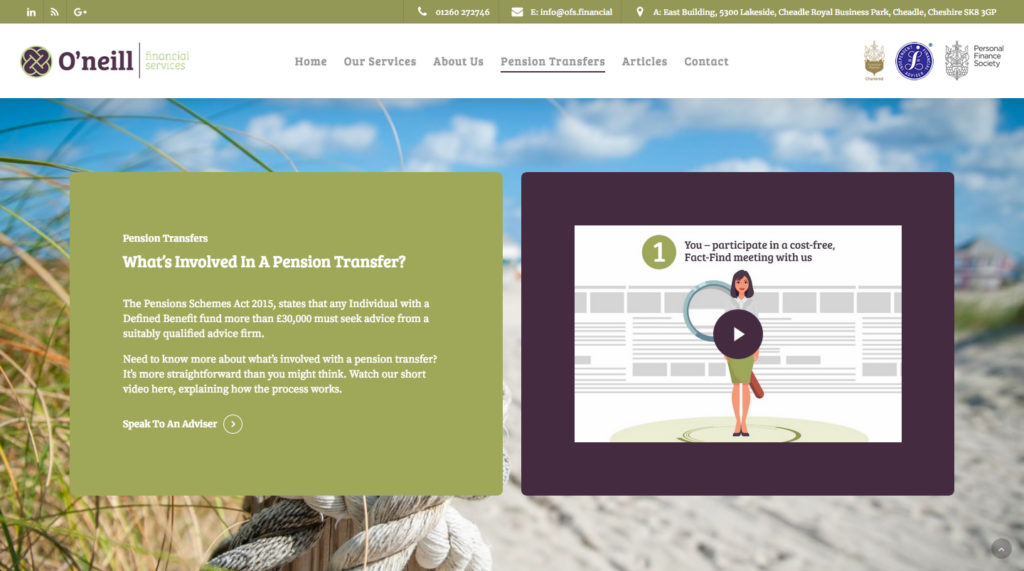

Utilising Video in Financial Services Marketing

Financial services often rely heavily on text-based marketing strategies. Yet an image really does speak a thousand words. Imagine what a series of images (a video) can do!

Videos are often far more effective in communicating complex financial concepts such as those relating to investment strategies, retirement planning or tax planning. For financial services offering a product (e.g. a fintech business), a video can be perfect for showing how it works and benefits customers.

Behind-the-scenes videos can be a fun strategy to include in your financial services marketing. This puts a “human face” on your brand by giving viewers a taste of your team, company culture and day-to-day operations.

Videos can also be helpful for your SEO and wider efforts to gain organic traffic. By including keywords in titles, descriptions and tags, a video can give your brand more exposure in video-driven algorithms (e.g. YouTube). Consider providing captions and transcripts to further boost your organic reach.

Mobile Marketing Strategies for Financial Services

Customers are increasingly relying on their phones to engage with financial services brands. Make sure your financial marketing is not simply built for desktops but also for many screen sizes and devices.

Marketing financial services increasingly requires mobile-first strategies such as in-app messaging, SMS and push notifications to targeted messages, alerts and reminders to customers’ mobile phones. This empowers them to enjoy a more seamless user experience when accessing accounts, checking balances, transferring funds and paying bills.

Make sure your financial marketing is attentive to providing responsive design, fast loading times and easy navigation – especially on smartphones.

Finally, consider how geotargeting and location-based tactics could add a further boost to your financial services marketing. For instance, larger financial institutions might provide personalised offers, promotions or branch information to users when they’re in close proximity to certain physical locations.

The Role of Artificial Intelligence in Financial Marketing

Artificial intelligence (AI) offers financial firms a lot of exciting opportunities for marketing in 2024 – especially with regards to making everything more personalised, efficient and data-driven.

However, these technologies are still in their infancy and regulations are still being ironed out in the UK, EU and other jurisdictions to govern AI responsibly. As such, in early 2024, it is probably wise for financial firms to take a “cautious integration” approach until some of the concerns (e.g. about customer data privacy and security) are addressed.

One area where AI can boost marketing productivity is in assisting with audience segmentation based on factors such as demographics, interests and past behaviour. This, along with AI’s power in predictive analytics, can help financial marketers be far more efficient when forecasting future customer behaviour and personalising messaging to existing customers in real time.

Finally, AI could be very useful to firms in aiding the rapid detection of fraudulent activities and suspicious transactions by analysing patterns, anomalies and deviations from normal behaviour.